Let me start by saying I’m no money expert. I’m just a formerly broke b*tch who finally figured out her finances, and I want to help anyone who might be struggling with their dollars to do the same.

I know that money can be an intimidating topic — and in this economy? It’s harder than ever to earn, save, and pay off debt. But, as I learned firsthand, ignoring the issues won’t make them go away. In fact, it will make them that much worse. I used to live every day in fear of the number in my bank account, but at the same time felt too stifled to do anything about it.

Now, I have more than $20,000 in my savings account. I paid off more than $5,000 of lingering student loan debt. I feel financially stable for the first time…ever. In turn, I feel less anxious and more in control of my life.

They say money can’t buy happiness, but the reality is that it’s an essential tool for a positive, healthy, and safe lifestyle. Here are the steps I took to get my financial sh*t together.

Healing Financial Wounds

I didn’t grow up with a lot, and all I knew about money from a young age was that we didn’t have enough of it. We moved in and out of apartments. My brother and I were on government-sponsored lunches at school. And I definitely didn’t own the overpriced Limited Too outfits that my upper-middle-class friends had.

All that said, my parents worked hard and sacrificed everything to give us the best possible life in a Southern California suburb, which is a privilege so many others don’t get. Nonetheless, the financial hardships I experienced in childhood negatively impacted my relationship with money as a young adult.

So, the first and most important step of my journey to financial literacy was to unlearn the thoughts and habits I’d built around money. I talked about my anxieties in therapy and started educating myself through reading, listening to, and following the work of financial experts. Eventually, I was able to shift from a scarcity mindset to an abundant one.

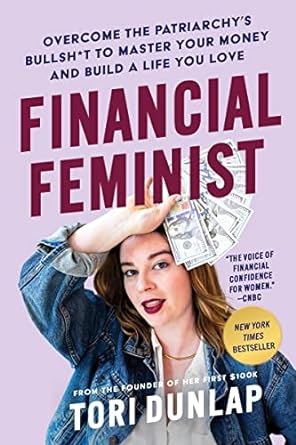

I recommend following Her First 100K. Her podcast and book (linked HERE) gave me the tools to identify my emotional issues around money and move on from them.

Shop Here: Amazon.com, $13

Finding a Side Hustle

No matter how healthy your relationship with money is, you can’t save it if you’re not earning enough. So my next step to financial stability was increasing my income. As a freelancer, I was always worried about when and from where my next paycheck would come. I was often scraping by and the money I did make would all go toward essentials and bills. I knew it was time for a change.

As much as I didn’t want to give up the freedom of working for myself, I knew that when a full-time opportunity came along, it was in my best interest to take it (even if only for a year or so). I was hired by a major media company and, thanks to the negotiation tools I learned in my research, I secured a decent salary. The game changer, though? I continued freelancing on the side.

Working extra hours outside of my full-time job wasn’t ideal, but there’s no way I would have been able to save as much as I did without it. Not only that, but it allowed me to enjoy life beyond the necessities — I could afford to attend friends’ weddings, buy furniture for my new apartment, and treat myself to concerts, date nights, or a cute new outfit. I worked hard and often spread myself thin, but it was well worth it in the long run.

If you’re not sure where to start, think about what you’re good at and what you enjoy doing, and go from there. You may be surprised to find a handful of part-time opportunities that align well with your needs and interests. Be a blogger, virtual assistant, delivery worker, dog walker, content creator, server, fitness instructor…the list of side hustle opportunities goes on.

Open a High-Yield Savings Account

Once I had decent savings, I moved my money from my regular savings account to a high-yield savings account (HYSA). The main benefit of a HYSA is that it earns a substantially higher interest rate. In other words, you’ll make money simply by storing your money there.

I finally opened my account in November 2023 and made an extra $180 by the end of the year. $180 might not seem like much in the grander scheme of things, but the more you put in the more you’ll earn. And every penny counts, right?

My only regret with my HYSA is not doing it sooner. I opened an account with Wealth Front, and the entire process took about five minutes. In 2024, I’ll make an extra $1,000 (or more).

If you don’t have your savings in a HYSA you’re missing out. Sign up for a Wealth Front account HERE.

Talk About It

Money can be a taboo topic, and sometimes it’s even considered rude to discuss. Well, I disagree (while keeping respectful boundaries in mind). I think the more we talk about money — with our friends, colleagues, partners, and social network — the more we can help each other learn, save, and earn the wage we deserve. So, find one or a few people who are open to discussing finances and check in with them often.

Every time I hit a milestone, or struggled with a setback, I texted my good friend to let her know where I stood. She helped hold me accountable and also encouraged me to keep going. Having even one person to support you can make all the difference. If you don’t feel like you have someone to do this with, turn to those online communities where like-minded people are sharing advice and support.

Again, I’m not an expert and still have a lot to learn — the next step in my financial journey will be investing! These are just a few things that helped turn my stressful money problems around.

Have questions or money tips of your own? Comment them below or DM me on Instagram!